What Bank Does Cash App Use for Withdrawals? [2024]

- Cash App is not a bank but partners with Sutton Bank and Lincoln Savings Bank. Sutton Bank issues the Cash Card for ATM withdrawals and purchases, while Lincoln Savings Bank handles direct deposits and withdrawals.

- Users can find their account and routing numbers within the app. Cash App ensures security through encryption and fraud detection, and funds are FDIC-insured up to $250,000 through its partner banks.

- Users don't need to link an external bank account to use Cash App. Services like transferring and receiving funds, and using the Cash Card, are available without linking to another bank.

Cash App, the popular mobile payments service, offers a plethora of services to its users, most of which are reminiscent of those offered by a traditional bank. However, you might wonder what bank does it use, if any, at the backend, and how do payments function within the app?

This guide will delve into these questions, exploring which banks Cash App utilizes, whether it is FDIC insured, and what options are available for direct deposit.

Table of Contents

What is Cash App?

Cash App is a financial platform available on Android and iOS, allowing users to easily make transactions online or send and receive money using the app. The service enables you to file your taxes directly from within the app, as well as invest in stocks, crypto, and ETFs, among other options.

Although Cash App itself is not a bank, it provides services similar to one, such as direct deposits, cash cards, and ATM withdrawals.

READ MORE: CashApp Not Working? Try these fixes! ➜

What Bank Does Cash App Use?

While Cash App itself isn’t a licensed bank, it facilitates money transfers and other banking-like features through its partnerships with Sutton Bank and Lincoln Savings Bank. This allows every Cash App user to have their own account and routing numbers, similar to what you’d find in a traditional bank account.

Furthermore, the funds held in your Cash App balance are deposited with its partner banks, which are FDIC-insured up to $250,000 per depositor. This means your money benefits from the same level of protection you’d expect at a FDIC-insured bank.

Both of the banks listed above provide different services. Lincoln Savings Bank primarily manages Cash App’s direct deposits and withdrawals. Sutton Bank, on the other hand, focuses on issuing the Cash Card, which allows users to make purchases and withdraw cash from ATMs.

READ MORE: Want to Delete your Cash App Account? Here’s How to Do it ➜

How to Find My Banking Details on Cash App?

While you may not need your account and routing numbers regularly, there are ways to find them if needed. However, it’s important to remember that Cash App itself does not store or display your full bank account information for security reasons. To find your routing and account number, follow the steps down below:

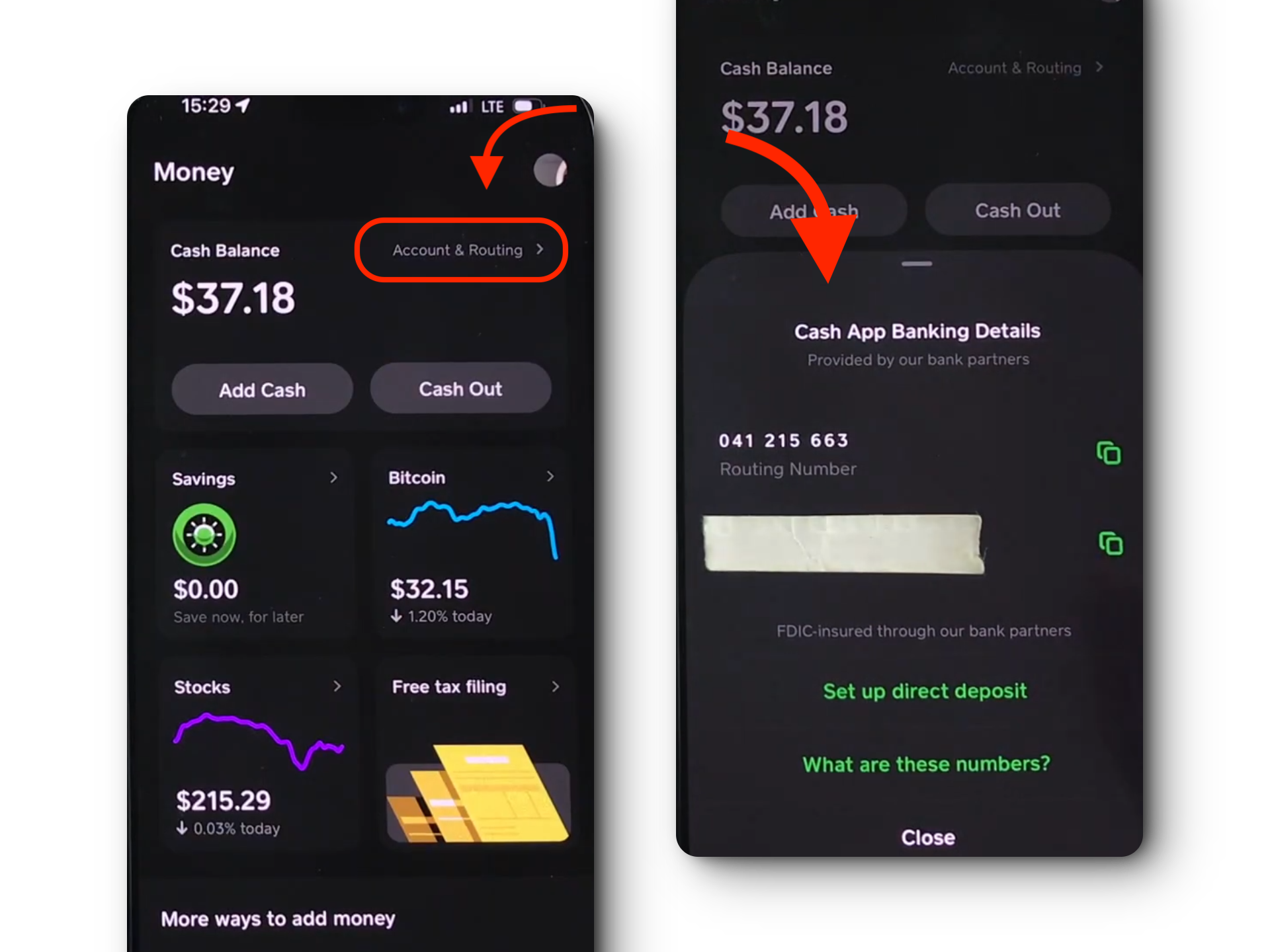

- Open Cash App and tap on the Money tab on the bottom left hand corner.

- Tap on “Account and Routing” next to your Cash Balance.

- A page will appear showing you your account and routing numbers.

To find your bank’s name, you can always copy your account’s routing number and paste it into Google. For reference, below are the routing numbers for the two associated banks:

- Sutton Bank: 041215663

- Lincoln Savings Bank: 073905527

Is Cash App Reliable and Safe?

Cash App has implemented several safety measures, such as industry-standard encryption, to protect your data and funds. Additionally, it has fraud detection systems in place to monitor for suspicious activity, along with FDIC insurance coverage. Therefore, the service is generally considered safe and is regulated by the Consumer Financial Protection Bureau (CFPB) under the Electronic Fund Transfer Act (EFTA).

Even with all the security systems in place, it is crucial to exercise caution and stay informed about potential scams. Never share your personal banking details, especially your PIN or sign-in code, with anyone. Be vigilant in identifying unsolicited messages or requests for money. Only send money to individuals you know and trust.

READ MORE: 7 Easy Ways to Earn Real Money From Your Android ➜

Conclusion

While Cash App does deliver a lot of services similar to traditional banks, it itself isn’t one. Instead, it partners with two FDIC-insured banks: Sutton Bank and Lincoln Savings Bank. These partner banks handle specific services like holding user funds and issuing Cash Cards, ensuring each user has access to unique bank details associated with their Cash App account.

FAQs

No, you don’t need any additional banking details for other services to use Cash App to transfer and receive funds. While you can link to an external bank account, it is not mandatory to do so since you can simply withdraw or make purchases via Cash App’s Cash Card.

The Sutton Bank is responsible for issuing Cash App’s Visa debit card.

Similar to how Sutton Bank and Lincoln Savings Bank handle the finances, third-party services like Block, Inc and Cash App Investing LLC handle crypto and stock exchange services, respectively.

Reviewed by

Reviewed by